To get the annual return I did 2.158925^(1/10)-1 which gave me 8% annual return, which is far away from the 15% I was hoping for. Let’s say the results of this calculation was 2.158925, which is the dollar return over the 10 years, including the original investment. I then calculated the compound return that a $1 investment would have earned had it been invested in this asset class for the whole 10 years. I started over this time generating 2,520 random returns (see note below) to represent ten years worth of data. However my focus should not have been on the mean return, but rather on the final return that, when annualized, would be close to my target input.

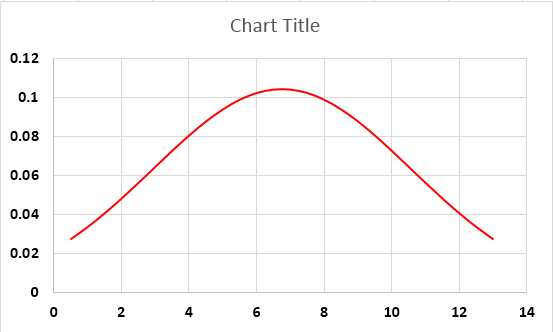

Because this is in the context of investments, where risk and return are (or should be) closely related, it was important that my final return was closely aligned to the target parameters, that is I couldn’t have an asset with higher risk have a lower return than an asset with lower risk, however my initial approach often led to this very situation.Īs mentioned above, the SD figure was always pretty close to the target, but the mean return varied widely. My aim was to generate daily returns for various asset classes given annual return and standard deviation figures. With the benefit of your explanation I managed to use the below solution (which I am including in case anyone else finds themself in my situation), confident that there is nothing wrong with the random numbers I generated. I had completely overlooked the expected variability around the mean. Thanks very much for your helpful reply joeu2004 (including the suggestion to use 252 trading days). Could you help me understand why the average of the generated numbers is not close to the inputted target mean?įor reference, below are the results of 10 different iterations of the 10,000 numbers generated using the above formula (target μ=0.06%, target SD=1.89737%): If I then take the standard deviation of the generated returns, it is generally within 5% of the target standard deviation, however the mean of the generated numbers varies widely from under -100% to over +100% of the target mean return. Assuming there are 250 trading days in the year, I am calculating my daily mean return as 15%/250 = 0.06% and my daily standard deviation as 30%/SQRT(250)=1.89737%. Let's say my annual return figure is 15% and my annual standard deviation figure is 30%. I am trying to generate random daily (stock market) returns with a normal distribution from annual return and standard deviation figures.

0 kommentar(er)

0 kommentar(er)